by BNET Editorial

Harvard professors Robert Kaplan and David Norton developed the balanced scorecard to help translate vision and strategy into action. This technique can make strategic planning a core part of any business. They showed that financial analysis, which is largely a look backward over past performance, isn’t enough to guide long-term investment decisions. That information alone doesn’t demonstrate how an organization can create future value. The balanced scorecard uses a more holistic approach to analyzing how information is gathered and used to deal with investment decisions and other issues. In addition, it acknowledges the importance of input from customers, suppliers, and staff; as well as data concerning processes, technology, and innovation, to help organizations create a desired future.

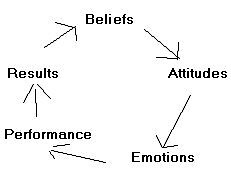

The balanced scorecard builds on other management ideas, such as total quality management (TQM), process, and business process re-engineering to provide a valuable strategic tool. The key difference between the balanced scorecard and the other approaches, however, is the extensive use of feedback loops—from both internal business process outputs and the outcomes of business strategies—to identify and understand organizational problems.

Most likely, people who use this technique will have to change their mindsets. Collecting and sharing extensive information about the company, in an organizational culture that considers information as power, will require a major change in behavior. Additionally, being responsible for outputs will require employees to explore and learn from each other and each situation. Some people will find adopting this openness very difficult.

What You Need to Know

Does the balanced scorecard really add value?

Guided by the principle that “what gets measured gets done,” organizations often find it easier to focus on business priorities by using processes like the balanced scorecard. In fact, research has shown that companies that measure their performance out-perform those that do not. Organizations need to prioritize effort and initiatives; this technique, which is also a philosophy of how to manage and involve people in decision making, helps them do so.

How do I motivate my team to embrace the balanced scorecard?

Use existing systems and processes to support this initiative. Once the feedback loops are in place, you will be able to reflect upon, and learn from, core business processes that will demonstrate the usefulness of the balanced scorecard technique. First, do the following:

- establish a current benchmark for all systems and outputs;

- communicate the direction/vision/strategy;

- stimulate action toward new performance levels and output;

- facilitate learning from each other and existing processes;

- help employees improve their behavior.

Establish agreed upon standards for correct behavior and monitor your team’s progress. Recognize improvement toward those standards, and reward positive changes in performance. New standards may include being open and exploratory with peers regarding current individual and team behavior, meaning that everyone will need to become comfortable sharing information and ideas (if they’re not already). Discourage behaviors that may be unproductive, such as negative commentary, unilateral management, and the withholding of information.

Work with your team to make the new behaviors routine and recognize what is being achieved when new performance standards and goals are met. Delivering results based on key priorities for the business produce a greater sense of accomplishment and, therefore, motivation.

What to Do

Set Goals

The underlying behaviors required of the balanced scorecard are the key to its success. Working together to achieve goals, with well-defined measurable areas of accountability and responsibility, helps you reach those goals and drives performance improvement. It’s also essential to set clear goals to generate and maintain motivation for achievement. There are several key requirements for making the balanced scorecard succeed, each outlined below.

Encourage Collective Understanding

Organizations that implement the balance scorecard concept successfully create a performance culture. As part of that process, everyone involved needs to know exactly what is needed and who they will be expected to work together to achieve the desired goals. Both staff and the management team will benefit from training so that they understand the importance of being cooperative, open and able to explore new areas, and being willing to commit to higher standards of performance and organizational achievement.

Emphasize Teamwork

So that what may be seen as a “fuzzy” concept becomes more easily accessible, hold workshops with employees and management to translate the strategy and vision into key performance indicators. Examine the various teams’ objectives and how success will be measured from every angle—financial, effectiveness, customer satisfaction, etc. Work with groups to design and develop the framework for measuring operational performance after setting overall objectives, identifying specific output targets, and performance indicators. Remember to consider all options before settling on a few conventional measures.

Apply Your Agreements

Once the system has been put in place, keep track of it and report back to management at agreed periods. Gather feedback from everyone impacted throughout the process so that you have a full picture of which elements are working and which need more attention. There are bound to be a few hiccups the first time the system is rolled out, so be prepared to set aside time to make necessary changes.

Measure Performance

Be sure performance factors include the four critical areas: financial, customer, internal business processes, and learning and growth. Organizations frequently have a bias towards one or two areas; remember balance is essential. You may need to manage others’ expectations, so emphasize the point of the balanced scorecard is balance.

Allocate Time for Feedback and Revision

Set aside plenty of time to review the process. For many people, this is the most difficult part because it often feels unproductive, but learning and continuous improvement are essential elements of the balanced scorecard approach. Once you get accustomed to the process, the benefits of program review will become clear. As learning and growth opportunities are identified, people we agree that the time is well spent.

Keep Everyone Informed

Put in place strong communication systems to keep employees and management well informed of progress: your company’s intranet is ideal for this purpose. Where action is needed to shore up problem areas, act quickly and alert both individuals and the team. Remember: inform, initiate change, improve performance. Also celebrate and reward success: it’s a great way of boosting motivation during a time of change.

Empower Employees

Empowering your staff to share and use information is a central tenet of the balanced scorecard approach, but managers who are used to (or prefer to!) control agendas may find this freedom threatening. Some training will be useful here, and will help them ultimately to facilitate employee empowerment and establish new boundaries across various systems and tasks.

Focus on Quality

Quality is important to the success of the balanced scorecard approach, but it’s a complex concept and means different things to different people. When you’re working with customers (both internal and external) on a project, make sure you take some time early on to work out exactly what you both understand it to mean in your context, and what you both expect the outcome to be. Invite feedback and be sure to act on it so that quality and output expectations are understood and met.

Demonstrate Supportive Leadership

If you’re a manager leading the charge on the balance scorecard, cultivate the following positive practices:

- When working as a team, help it become self-managed and one that shares responsibility among its members;

- Recognize that in a participative environment, it is not important for you to always have (or need to have) the answer to every issue;

- Keep the team focused on results;

- Help the team learn collectively;

- Help the team see its results and understand how they were achieved;

- Role model sharing information and being self-disclosing (both about what you know and your responsibilities);

- Think strategically and share your knowledge of the past when it is in service to the future;

- Be decisive;

- Set unambiguous lines of ownership and responsibility for resolving issues;

- Keep a can-do attitude and an open mind.

What to Avoid

You Don’t Understand the Process

Unless there is real understanding and commitment from the senior management team, it will be difficult to drive the balanced scorecard initiative through to a successful implementation: serious issues will arise as motivation flags and commitment falters. By the same token, without the buy-in of all employees, the process will never get off the ground. Make sure you convince participants of the wisdom and benefits of using the new technique and be ready for some resistance at first.

You Try To Do It All in One Go

Implementing a balanced scorecard throughout the organization is a big job, and you stand a better chance of succeeding if you do it in stages. It may also be useful to try out your planned implementation process on a supportive, small test group whose feedback you can act on before the program goes organization-wide.

You Don’t Communicate Effectively

For the balanced scorecard to succeed, it’s essential that everyone is kept in the loop. Remember, at the outset, it is better to communicate too much than too little. Make sure your goals have been explained clearly, that everyone is aware of their role in the process, and that

you gather feedback as the project is rolled out.

Where to Learn More

Books:

Niven, Paul.

Smith, Ralph F.

Web Sites:

Balanced Scorecard Collaborative: www.bscol.com

Balanced Scorecard Institute: www.balancedscorecard.org